State-Wise Vehicle Registration Fee Structure in India

Every vehicle owner in India knows that buying a car or bike is not just about paying the showroom price. There are multiple additional costs—insurance, road tax, and most importantly, vehicle registration charges collected by the Regional Transport Office (RTO). Without registration, your vehicle cannot legally ply on Indian roads.

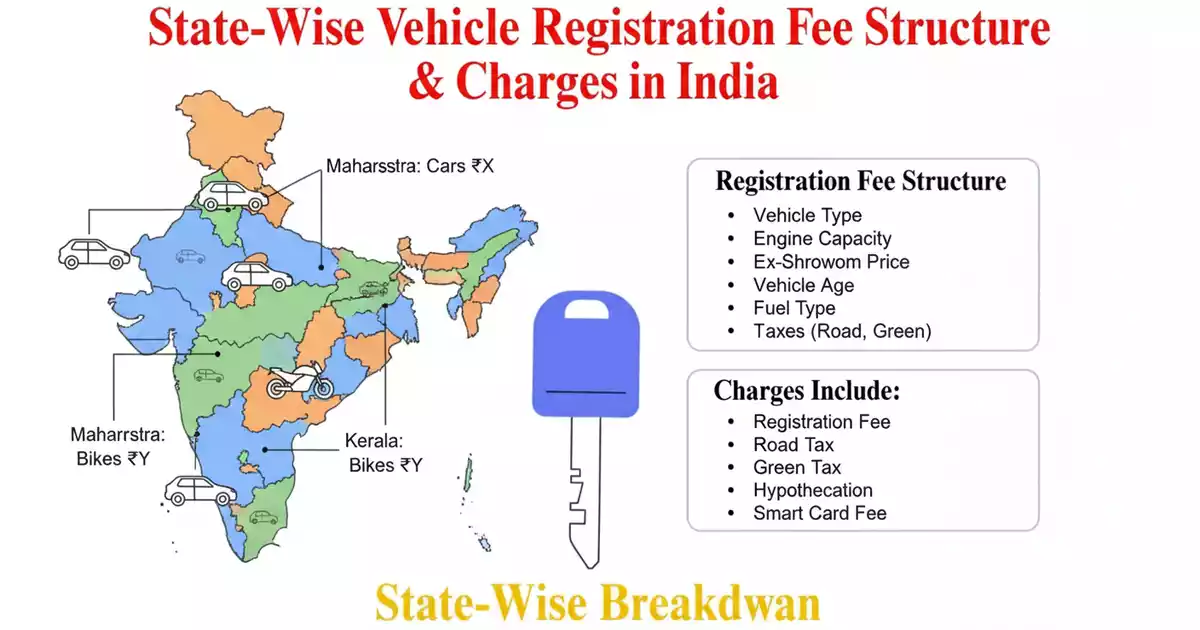

What makes it interesting is that registration fees differ from state to state. For example, buying the same car in Delhi may cost you less in terms of RTO fees than in Karnataka or Maharashtra. This article will give you a clear, state-wise comparison of vehicle registration charges in India, factors that influence the fee, and why they vary across states.

1. What is Vehicle Registration?

Vehicle registration is the official recording of your vehicle with the RTO. Once registered, your vehicle is assigned a unique number plate that acts as its identity. This process ensures:

- Legal ownership proof of the vehicle.

- Compliance with the Motor Vehicles Act, 1988.

- Easy tracking of theft, accidents, or violations.

- Road tax collection by the government.

Without registration, a vehicle is considered illegal and cannot be insured or driven on public roads.

2. Components of Vehicle Registration Fees

The RTO registration fee isn’t a single charge. It is made up of several components:

- Basic Registration Fee – The standard cost of registering the vehicle.

- Road Tax (One-time) – Collected by states to maintain infrastructure.

- Number Plate & HSRP Fee – Mandatory High Security Registration Plate (HSRP).

- Inspection Charges – For verifying vehicle condition.

- Hypothecation Charges – If the vehicle is purchased via loan, this fee applies.

- Green Tax (in some states) – For older vehicles contributing to pollution.

3. Factors Affecting Registration Charges

Why do states charge differently? The fee is influenced by multiple factors:

- Vehicle Type – Two-wheelers, cars, commercial vehicles have different slabs.

- Engine Capacity – Higher cc engines attract higher fees.

- Ex-Showroom Price – Luxury cars attract higher registration charges.

- Fuel Type – Diesel vehicles may attract higher fees due to environmental concerns.

- State Policies – Each state has its own RTO rules and tax slabs.

4. State-Wise Vehicle Registration Fee Structure (Comparison Table)

Here’s an overview of how registration charges vary across some major states in India:

| State | Registration Charges (Cars) | Two-Wheelers | Special Notes |

|---|---|---|---|

| Delhi | 4% of cost (up to ₹6 lakh), 7% (₹6–10 lakh), 10% (above ₹10 lakh) | 4% of vehicle cost | EVs exempted from road tax |

| Maharashtra | 7–11% of vehicle cost | 10% of vehicle cost | Green cess applicable |

| Karnataka | 13–18% of vehicle cost | 12% of vehicle cost | One of the highest in India |

| Uttar Pradesh | Flat 9% of vehicle cost | 8% of vehicle cost | Concessions for women owners |

| Tamil Nadu | 10–15% of vehicle cost | 8% of vehicle cost | Road safety cess applicable |

| Gujarat | 6–10% of vehicle cost | 6% of vehicle cost | Lower for EVs |

| West Bengal | 6–10% of vehicle cost | 6% of vehicle cost | EVs exempt till 2025 |

Note: Charges may vary slightly depending on vehicle category, location, and RTO updates.

5. Why Karnataka and Maharashtra Have Higher Fees?

States like Karnataka and Maharashtra are known for higher RTO charges. This is due to:

- Higher road infrastructure investment.

- Extra state cess and surcharges.

- Higher number of luxury vehicle registrations.

For example, registering a luxury SUV worth ₹50 lakh in Karnataka could cost significantly more than in Delhi.

6. Exemptions & Discounts on Registration Charges

Some categories of vehicles and owners get concessions:

- Electric Vehicles (EVs): Many states (Delhi, Gujarat, West Bengal) offer full or partial exemption.

- Women Owners: States like Uttar Pradesh provide reduced charges for women registering vehicles in their name.

- Disabled Persons: Specially designed vehicles for disabled individuals often get discounted registration fees.

- Government Vehicles: Exempt from registration fees in most cases.

7. Penalties for Driving Unregistered Vehicles

If you drive without proper registration, be ready for:

- Fine: Up to ₹5,000 for first offense, ₹10,000 for repeat offenses.

- Vehicle Seizure: Authorities can impound unregistered vehicles.

- Insurance Rejection: Claims are not processed without valid registration.

8. Future of Vehicle Registration in India

India is slowly moving towards digital and uniform registration systems. Possible future changes include:

- Nationwide uniform road tax instead of state-wise variations.

- Smart Digital Plates linked to GPS and insurance.

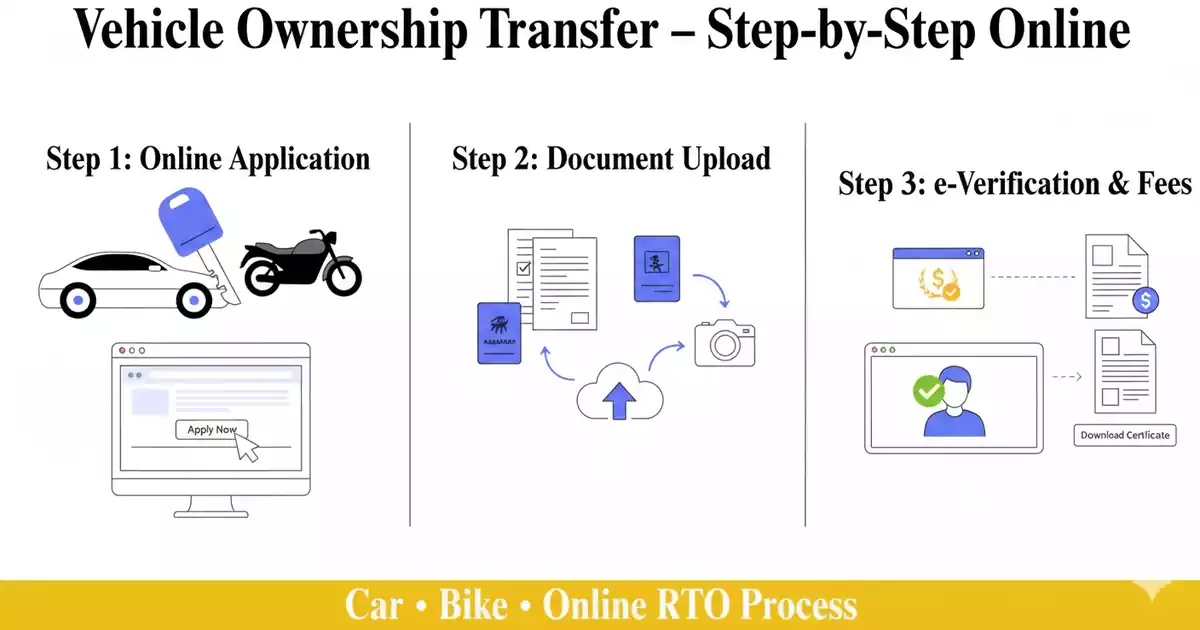

- Online-only RTO services for registration.

- More exemptions for EVs to encourage green adoption.

Conclusion

Vehicle registration is more than a legal formality—it’s a crucial step that ensures your vehicle is officially recognized, insured, and roadworthy. However, the fee structure varies widely across states, sometimes making vehicle ownership costlier in one state compared to another.

As India moves toward EV adoption and digitalization, we can expect more standardized processes and relief for eco-friendly vehicles. Until then, knowing your state’s RTO charges helps you plan your purchase smartly and avoid unexpected costs.

FAQs

1. Why are registration fees different across states?

Because each state government has the authority to levy road tax and registration charges as per their policies.

2. Do electric vehicles need to pay registration fees?

In most states, EVs are fully exempt or charged at reduced rates.

3. Is temporary registration allowed?

Yes, temporary registration is valid for 30 days until permanent registration is completed.

4. How much is the penalty for driving an unregistered car?

Up to ₹5,000 for the first offense and ₹10,000 for repeat offenses.

5. Can I transfer vehicle registration from one state to another?

Yes, but you need to apply for No Objection Certificate (NOC) and pay applicable charges in the new state.